Game in great shape and demand is strong — but supply chains the main concern for golf’s biggest brands

It doesn’t take a forensic look at the transcript of the earnings call for Acushnet Holdings’ most recent earnings report, on Q3 2021 which they rolled out last month, to see the thing that’s causing either sleepless nights or fully awake management meetings at one of golf’s biggest companies.

Acushnet is the publicly traded company behind Titleist and FootJoy, two of the game’s most recognisable brands.

And in their earnings call as part of investor relations on Thursday, November 4th, President and CEO David Maher and Chief Financial Officer Tom Pacheco were not holding back on where they see the challenges in the present and near future for their company.

Supply chains.

That little two-word phrase was mentioned a staggering TWENTY-NINE TIMES during the 39-minute presentation and analyst Q&A.

The two key pieces of the supply chain puzzle for Acushnet have generated increasing costs across the board, everything from freight and fuel on the one hand to raw materials and manufacturing on the other. The increased costs primarily related to the golf ball business, but no segment escaped those challenges.

Investments in new and more powerful manufacturing and supply chain processes in recent years have seen Acushnet roll out production facilities in the likes of Thailand and Vietnam, locations that have seen output slow on more than one occasion during the pandemic due to rising Covid-19 cases and the slower roll-out of vaccination programmes there.

As Maher said in that earnings call, though, it is expected that some of those situations will ease in the near-term future:

“While availability has been impacted by factory shutdowns in Vietnam, we are seeing the situation begin to stabilize as vaccination rates climb.”

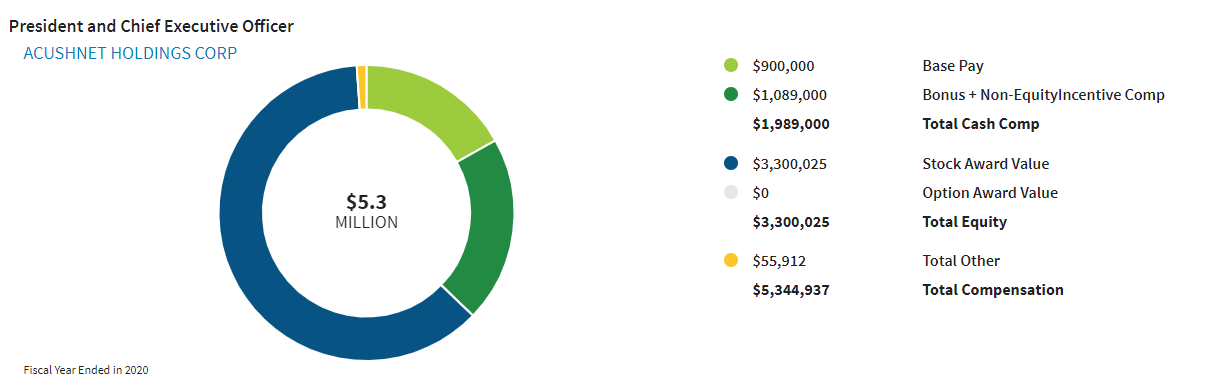

If there are challenges, and there clearly are, and Acushnet continues to perform robustly through them, Maher (pictured) will certainly have earned his salary.

As President and CEO of Acushnet, he had estimated earnings of more than $5.3 million in 2020, including a base salary of $900,000, more than $1m in bonuses and $3.3 million in stock award value.

Back to business, though.

Those increasing supply chain costs (coupled with an unwillingness on behalf of the company to implement any unit price increases on existing product lines) resulted in a marginal dip of gross margin for Acushnet.

However, that gross margin remained healthy at 51.5% and while Maher and Pacheco, answering an attendee question in relation to a further anticipated fall in gross margin in Q4, are prepared for another dip before the end of the year, the company’s profitability remains solid.

That profitability was only one element of what was overall an impressive earnings report, in which they outlined almost insanely good numbers of sales revenue both in July-September and on the year to date.

Some top-line figures for Acushnet in Q3

Year-to-date total revenue for 2021 was more than $1.727 billion

That revenue number was up 45% on 2020 (which had of course been impacted by Covid restrictions, although the game saw a big participation spike as restrictions were eased)

Even more impressive, the YTD sales figure was up 32% on 2019, demonstrating both the rude health of the game around the world and also the good standing of the Titleist and FootJoy brands

EBITDA (earnings before interest, taxes, depreciation and amortization—a figure often singled out by analysts as a good way of determining a company’s success and wellbeing) was $333 million for the nine months to end of September, a figure that was up 80% on 2020 and 70% on 2019

The company’s success really is a phenomenon driven by the entire globe: the year-on-year growth in sales across the regions showed a 30% rise in EMEA (Europe, Middle East and Africa)—and that was the slowest rising region! Sales were up 33% in Korea, almost 45% in the USA, and 48% in Japan—perhaps influenced by the arrival of the Olympics in Tokyo and the continued boost felt by the Masters success of Japanese superstar Hideki Matsuyama (notwithstanding the fact that Matsuyama uses no Titleist equipment)

The twin drivers of Acushnet’s success

It would appear that the twin drivers of Acushnet’s roaring success through 2021 are:

The power, recognisability and trust that lies within its brands

The surging global demand in the game since the Covid-19 lockdowns and closures of the spring of 2020.

Let’s briefly go through each of those in turn.

1. The authority of the Acushnet brands

I mentioned above that Matsuyama, who uses a mix of equipment including Srixon ball, driver and irons, TaylorMade and Cobra woods and Cleveland RTX wedges, is one of the few players on the PGA Tour NOT to play a Titleist Pro V1 or Pro V1X ball.

That fact was underscored during the Acushnet presentation by CEO Maher, who expressed his satisfaction with the fact that 73% of players across worldwide tours play a Titleist ball, with Pro V1 and Pro V1X leading the way.

In his investor relations presentation, Maher also mentioned Titleist’s position as the “golf ball innovation and performance leader”, following the launch of new Pro V1 balls with Radar Capture Technology, which syncs up with Trackman devices to bring the ball-tracking experience of pro tour television coverage to avid amateurs around the world.

While Titleist is Acushnet’s 800-pound gorilla—Titleist golf ball sales accounts for $543 million, or approximately a third of all Acushnet sales so far in 2021—it is not the only big golf brand within the company’s portfolio.

The FootJoy range of shoes and apparel has become almost ever-present on all the main pro tours, and it is now the second-largest item in the Acushnet inventory: its $462 million in sales in the nine months to the end of September was up more than 40% on 2020.

2. The growing demand for the game

Given that players must play for Acushnet’s brands to hit their numbers (those Pro V1 balls and FootJoy shoes are not much use to anyone gathering dust in the garage...), Acushnet tracks “rounds of play” figures closely.

It found that YTD, rounds of play were up between 8-15% in the three biggest markets, USA, Japan and Korea—although given that many courses had necessary closures for many weeks or even months in the spring of 2020, those figures might not be too surprising.

Indeed, the National Golf Foundation tracks rounds of play figures and found that in the main summer months of 2021, July and August, a combination of (1) a natural fall-off from the post-closures participation spike of 2020 and (2) unseasonably wet weather in many parts of the US, resulted in a decline in those months.

But still, given those fast rising sales figures in every region, there’s little doubt that the game of golf, as a naturally socially distanced leisure activity that also contributes to physical fitness and friendships—two key signals of overall good health, wellbeing and virility, priceless commodities in a pandemic world—is in a good place all over the world.

And Acushnet, with its brand recognition and its capacity to deliver much-wanted products into the hands of millions of ready-to-spend golf enthusiasts all over the globe, is well positioned to serve that market well.

Provided those supply chains don’t suffer any further pandemic-related aftershocks.

Sign up

Hope you enjoyed this article.

The Wedge is a regular newsletter about the intersection of golf, money and business.

Sign up now to receive each new edition in your inbox for free.