2023 Retrospective, Part 2: Golf's new media explosion, golf-as-entertainment and gender researchers take aim at the greatest game

In the second of a two-part end of year special, a look at this year's developments in the business and money of golf.

This article is 2477 words. Estimated reading time: 11 minutes

Welcome to Part 2 of this retrospective at the world of golf, business and money in 2023 (trying, of course, not to forget some of the mystique of the world’s greatest game too.)

Part 1 was all about events at the top of the pro game and L__ G___ and the P__ T___.

It drew attention not to the detail of what happened with the so-called merger or what we’re supposed to think of Jon Rahm now, but instead trying to look at the bigger picture of America’s place in the world, the possibilities presented by golf’s growing pie and what the past 18 months might have done to Rory McIlroy.

Part 2 tries to mostly avoid all of that, looking instead at some of the other interesting stories to break, develop or be ignored over the past 12 months.

Onwards.

Thank you for being here. The Wedge is a reader-supported publication. If you enjoy these articles and would like to support independent media focused on the business, money and mystique of the world’s greatest game, please consider a monthly or annual subscription or gift a subscription to someone who might value this content.

1. Golf’s new media explosion

Golf’s media landscape has been going through a fundamental transition over the past decade, and if everyone is being truly honest with themselves, this transition is probably a big reason for so much of the anti-LIV sentiment over the past 18 months.

Why?

Because one of the most striking things about the LIV project is how it doesn’t seem to have placed any importance on traditional media attention.

After streaming free on YouTube for its first season in 2022, LIV secured a US TV rights deal with The CW network in January, but data on viewership figures was increasingly hard to come by as the year went on.

The CW is still in the early stages of its transition into ownership by Nexstar Media Group, a transition that started — unpromisingly if growth is to be considered a primary target — with declarations that the network was paying far too much on programming, cancellations of a host of shows and pledges to acquire less resource-intensive content.

As 2024 is the final year of that two-year deal with LIV, the coming year has been described as a make-or-break one for both the channel and LIV’s American media aspirations.

But this is also looking at media through a well-established lens that is, everywhere you look, being destroyed by newcomers and upstarts.

Media has changed fundamentally for every sport over the past decade, and because golf globally is about participation, personal improvement and networking more than partisanship and supporting favorite teams and players, the game seems to be leading the way in that sports media transition.

YouTube is at the forefront of this change, and one truly spectacular symptom of the transformation that has taken place is that in an analysis of golf-focused YouTube channels, the top three categories do not contain traditional media.

Instead, the three categories are:

Influencer media

New media

Official organization channels

A fuller analysis might follow here in the coming weeks, but preliminary findings are that EIGHT(!) of the top 10 spots (in terms of YouTube subscriber numbers) are filled by golf influencers.

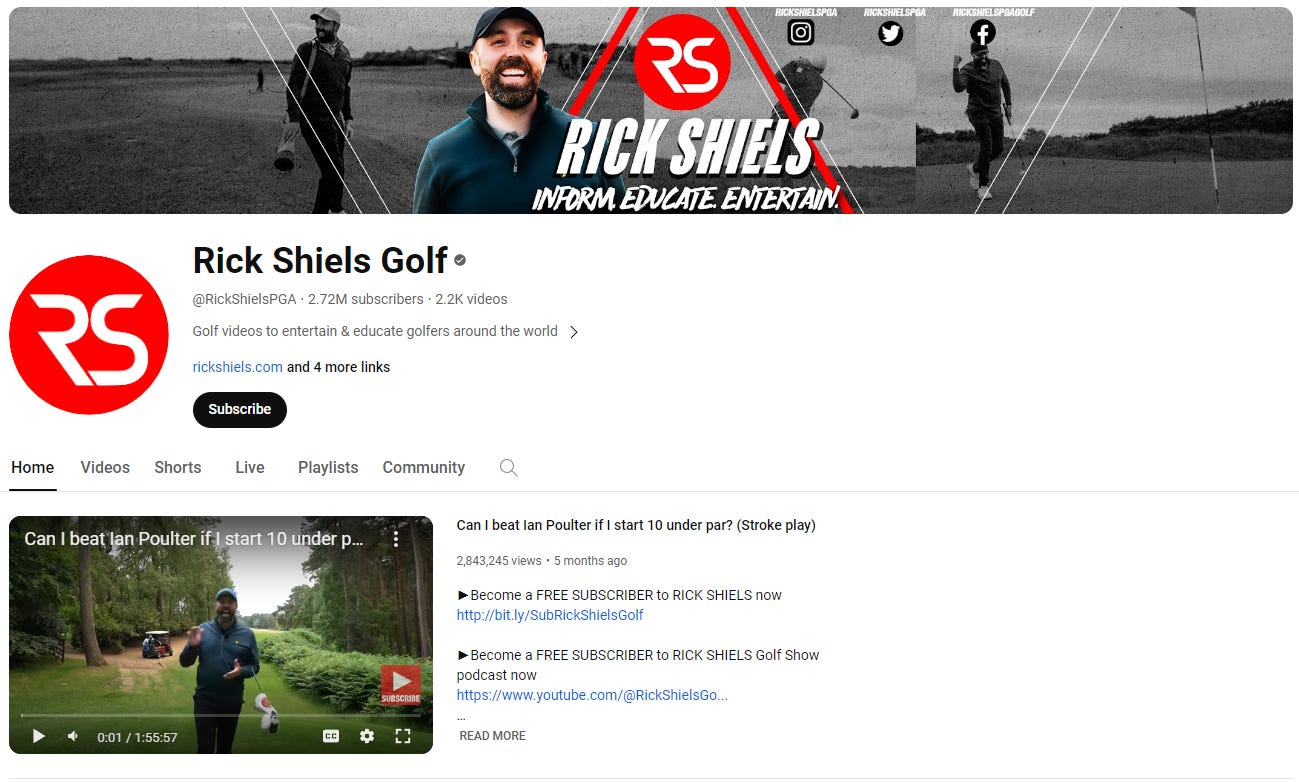

The top spot is held by Rick Shiels Golf, who has amassed 2.72 million subscribers and a staggering 753 million video views.

By comparison, the PGA Tour has almost twice as many total video views on YouTube (almost 1.5 billion) but has less than half the number of subs (1.3 million). On top of that, the PGA Tour has had to work much harder — it has published approximately 19,000 videos while Shiels has posted 2,200.

Other “influencers” to appear in the top ten include online golf coaches Danny Maude (1.2m subscribers) and Peter Finch (600,000) and content creator Garrett Clark (GM Golf), who recently passed the 1 million mark.

Intriguingly, one of the fastest growing “influencers” is Major winner and LIV Golf star Bryson DeChambeau.

Bryson’s decision to move to LIV in 2022 was itself influenced by the freedom he would be allowed to create, run and presumably monetize his own golf content over time.

At the time of writing this (on December 29th, 2023), DeChambeau had 447,000 subscribers, and 2023 was a year of major growth for him.

The total video view count on his YouTube channel almost doubled in 2023 to more than 33 million video views.

Most strikingly is his view per video rate. DeChambeau has posted just 64 videos on YouTube but has an average view per video rate of more than 525,000 views.

Every major golf YouTuber in this preliminary analysis had posted significantly more content — most in the hundreds and several in the thousands of videos published — but only new media sensation Good Good has a higher view-per-video rate than DeChambeau.

Bryson DeChambeau hits it big on and off the golf course.

Speaking of Good Good, that channel is the top golf media business on YouTube with more than 1.4 million subscribers and over 350 million video views. Their growth in ‘23 was also staggering: their total video view count was up 63% year on year.

By comparison, Golf Digest is the highest performing traditional media company on this new media format. It has 271,000 subscribers and 122 million video views, leaving it marginally ahead of The Golf Channel (234,000 subs and 101 million video views).

Elsewhere in golf media in 2023, perhaps the biggest story of the year was Netflix’s Full Swing show, which debuted in February and featured behind the scenes access to a host of pros, including Justin Thomas, Jordan Spieth, Rory McIlroy and Collin Morikawa.

Perhaps fittingly for the direction of travel when it comes to golf media — which seems to value truth, authenticity and genuine fun more than the boring staged reality of superstardom — the most interesting episodes featured the agonizing soul-searching of Brooks Koepka as he tried to get back to Major contender (which he soon did, contending in the Masters before winning the US PGA for his first Major win in five years and fifth in total), the ups and downs of journeyman pro Joel Dahmen and the family first orientation of Tony Finau.

After the toe-in-the-water reality of Season 1, the second season of Full Swing in 2024 should be even better and offer more nuggets from the true reality of life on tour.

And all of this — the rapid rise of do-it-yourself new golf media, paired with the widening reach of Netflix — hammers further nails in the coffins of traditional media establishments which seem to be scrambling to save their print and broadcast businesses even as everyone everywhere turns to streaming and on-demand.

Those who in the past controlled mass broadcast radio and television and the newsstand on the corner are unlikely to control the new formats and mediums that cater for a million niche interests.

Established media outlets are cornered dogs now, and they will bite — as we’ve seen through its trenchant opposition to LIV Golf — but the writing is on the wall for all of them.

2. Golf as entertainment, both out and about and at-home

One of the features of the Covid-19 pandemic was the way other entertainment and leisure businesses started to look enviably in the direction of golf.

Yes, golf travel went off a cliff for a year or more, but that rebounded quickly as airports opened up to pent-up demand for the world’s great golf experiences, and elsewhere, golf has benefited in countless ways.

For starters, golf was an outdoor and naturally socially-distanced exercise option for people of all ages at a time when indoor gatherings were outlawed almost everywhere. (Whatever about clubhouses, it is an enduring mystery that golf courses were closed in many countries and states during the lockdown chapter of our recent shared history.)

During Covid-19, millions of people all over the world, short of other things to do for the first time in their life, picked up a club for the first time, and very many of them seem to have enjoyed that experience.

And perhaps the most notable outcome of all that is not reflected in club membership numbers — because let’s face it, club membership is often as much about exclusivity as it is about including new people.

No, perhaps the most notable outcome of the past three years has been the growth of golf as entertainment, both at home and out of doors.

Topgolf, which joined forces with Callaway Golf in an acquisition worth approximately $2 billion in 2021, has quickly become one of the most sought-after entertainment pursuits in the US.

Figures for 2022, the first full year following the acquisition, showed that Topgolf was the largest segment of Callaway’s overall revenue for the year (39% for Topgolf, against 35% for “golf equipment”, including clubs, balls and the market-leading Odyssey putter range, and 26% for “active lifestyle”, or clothing).

Topgolf added 11 new venues in 2022 to a total of more than 80, and more are being added all the time. (The official website shows “Coming Soon” badges for new venues in Los Angeles and Raleigh-Durham.)

Results during 2023 showed that growth is continuing at a serious clip. After that 2022 result ($1.5 billion in Topgolf revenue), Topgolf took in $471 million in Q2 alone. By Q3 results, it was accounting for more than 43% of Callaway’s earnings.

Interestingly, this performance might have cast a negative shade on the rest of the Callaway company: at one point in November, its stock was down 49% for the 2023 calendar year. At the time of writing it has recovered somewhat but is still down 27% year to date.

The broader Callaway share price should not deflect from the outrageous success of Topgolf, however. After that $1.5 billion revenue figure in ‘22, it looks well on course for a significant jump in ‘23 after three straight quarters in excess of $400 million earnings.

The rest of the world seems to be way behind the golf-as-entertainment trend, but it will catch up, and Topgolf (and Callaway) seem to have stolen a march on all other players.

Meanwhile, at home golf is also growing rapidly as technology continues to advance the way technology typically does — a better experience at a lower price.

Many golf simulators and radar launch monitors are now available for less than $10,000, with some of the market leading options available for less than $30,000 (see this excellent breakdown by Jared Doerfler over on Perfect Putt).

All of this makes simulators an attractive new option for golf addicts who might like an alternative to driving to the course and having to deal with everything from slow play to inclement weather.

3. Is golf a factor in gender discrimination at major companies?

That’s what researchers from Miami University and the University of Cincinnati assert following a major study conducted over 12 years.

In a paper titled “Hitting the grass ceiling”, and published this year in the Southern Management Association’s Journal of Management, the researchers — Lee Biggerstaff and Bradley Goldie of Miami and Joanna T. Campbell of Cincinnati — analyzed executive teams of more than 4000 CEOS, and found that the leadership candidates hired by CEOs who played golf (numbering 760 in the study) were much more likely to be male, and the female executives they hired were much more likely to be underpaid compared with their male counterparts.

There’s no doubt that some time and effort went into the research: those 4000+ CEOs were tallied against data in the USGA’s handicap system and a Golf Digest list of golfing CEOs.

Ms Campbell, one of the authors of the study, told Forbes:

“Golfing CEOs spend a lot of time in environments that normalize exclusion, and especially gender-based exclusion. As you spend time on the golf course and in the country club, you start to internalize the idea that women are different… it’s OK for them to be treated differently and left out of ‘men’s spaces’ – that’s where the male-only grills and bars (known as the 19th hole) come from.”

Now call me a chauvinist (I am a white man, after all; please ignore that I’m from a country that has never colonized anyone and been colonized by the British for 800 years) but the main thing I took out of this quote was that it included several layers of speculation that didn’t exactly make me have a whole lot of trust in the underlying research findings.

She speculates:

That golfing CEOs “spend a lot of time” in golf environments

That these environments “normalize exclusion, and especially gender-based exclusion”

That this makes one “internalize the idea that women are different”

And that this is where “male-only grills and bars” come from (and presumably all the other “male-only” stuff that can only ever be a Very Bad Thing)

Now, as anyone who has spent time in clubhouses will know, there’s no doubt that some people who play golf can be elitist and exclusionary.

But this is to ignore that giant strides have been made in women’s golf at all levels, from grassroots participation to record-breaking Major prize money.

To blame the game of golf for gender disparities in corporations strikes me as trying to find a result to fit a chosen hypothesis rather than do the harder work of conducting real and useful science.

Gender researchers seeking things to blame for disparities and inequalities always have a hammer, and everywhere they look they find a nail.

Perhaps most interestingly, the same researcher in that same Forbes article pointed to a study from Singapore published in 2016.

Far from backing up the research, this study suggested that a good way for girls and women to benefit in the workplace is … drum-roll … to take up golf!

But but but?

If taking up golf is open to girls and women, and the social upside of golf can include building the relationship capital that might bring far-reaching benefits in work, business and life, what, exactly, is wrong with that?

Let’s allow a last word of rebuttal from an article written by Tom Budsman and published in Fore magazine in July:

“One could reasonably deduce that there are those that feel like if golf didn’t exist, many of these problems [i.e. gender pay disparity] might not, either.

Take a CEO and his buddies off a golf course, and—presto!—gender inequality at the workplace disappears, too. Afterall, what’s a bad actor without his stage to play on?

This is the guilty-by-association reputation that golf has been saddled with by its non-players and detractors forever. Never mind that it’s criminally untrue. Golf courses have myriad tangible benefits that stretch far and wide. And the great majority of the upside is enjoyed by the 99 percent of us who aren’t in the corner office of a high-rise.”

Bravo, Tom!

Thank you for being here. The Wedge is a reader-supported publication. If you enjoy these articles and would like to support independent media focused on the business, money and mystique of the world’s greatest game, please consider a monthly or annual subscription or gift a subscription to someone who might value this content.